Contact your donor-advised fund (DAF) provider or log in to your DAF account online and request to recommend a grant to "Cru" or "Campus Crusade for Christ" as the recipient organization. Provide the following information:

Specify the amount you wish to grant and include the purpose of the grant, if any (like to a specific Cru ministry or missionary).

Submit the grant recommendation through your DAF provider and receive a grant acknowledgment letter from Cru.

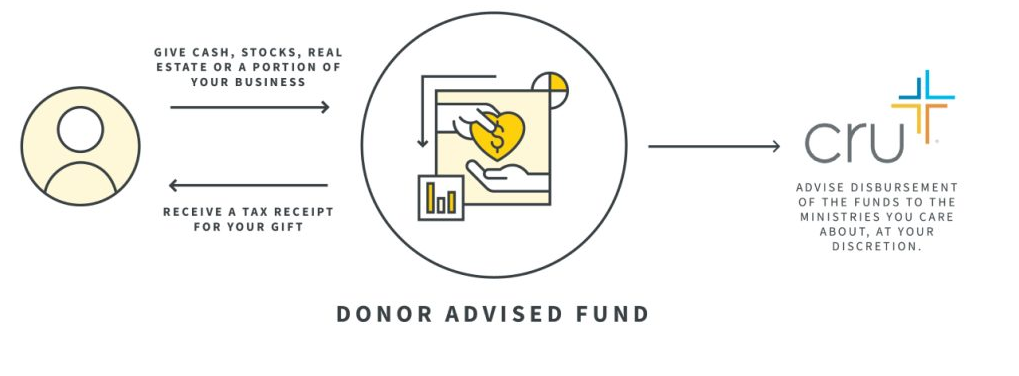

A Donor-Advised Fund is like a charitable checking account that serves as a hub for all your giving. One can establish a fund with cash, stock or other appreciated assets. You realize any tax benefits for which you qualify in the year of the donation. You can then recommend grants from your fund to the charitable organizations of your choice. In the meantime, the balance is

Cru Foundation is a ministry back to you. We exist to help you invest in building the kingdom of God now, during retirement and beyond your lifetime. The Great Commission Donor Advised Fund (GCDAF) is one of the tools to help you do just that! Here are three benefits of the GCDAF:

You can establish a new Great Commission Donor Advised Fund today or switch your current Donor-Advised Fund from another DAF provider. Switching is as simple as initiating a “grant” to Cru Foundation for the full amount of funds in your current DAF (or a partial amount if you would like to keep both accounts).

Have questions? Email us at info@crufoundation.org or visit crufoundation.org/GCDAF and learn about the Great Commission Donor Advised Fund (GCDAF) through Cru Foundation. Ready to apply?

©1994-2020 Cru. All Rights Reserved.